Europe Direct Drive Wind Turbine Market Overview

The Europe direct drive wind turbine market is gaining strong momentum as the region accelerates its transition toward renewable and low-carbon energy systems. A direct drive wind turbine operates without a gearbox, connecting the rotor directly to a low-speed generator. This design eliminates one of the most failure-prone components found in conventional wind turbines, resulting in higher system reliability, reduced maintenance needs, and longer operational lifespans. These advantages make direct drive turbines especially suitable for offshore and large-scale onshore installations where access and maintenance are challenging and costly.

Europe has emerged as a global leader in wind energy deployment, driven by ambitious climate targets, technological leadership, and supportive regulatory frameworks. Countries such as Germany, Denmark, the United Kingdom, and the Netherlands have been at the forefront of adopting direct drive technology, particularly in offshore wind farms. The region’s commitment to energy security, decarbonization, and long-term sustainability continues to fuel demand for advanced turbine technologies that offer both efficiency and durability.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=europe-direct-drive-wind-turbine-market-p.php

Europe Direct Drive Wind Turbine Market Size and Forecast

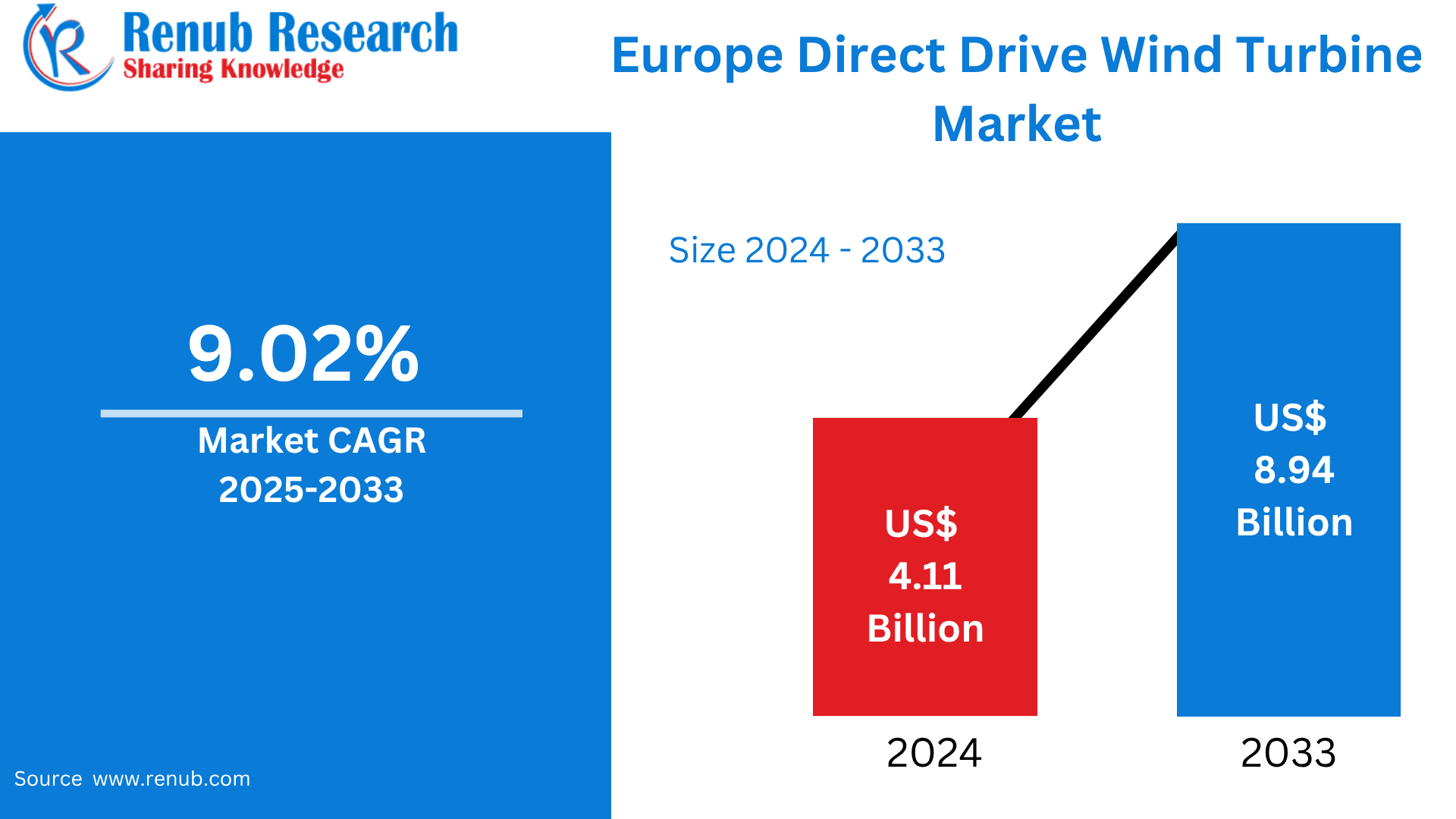

The Europe direct drive wind turbine market is projected to grow steadily during the forecast period from 2025 to 2033. The market is expected to expand from US$ 4.11 billion in 2024 to approximately US$ 8.94 billion by 2033, registering a compound annual growth rate of 9.02%. This growth reflects increasing investments in renewable energy infrastructure, rising offshore wind capacity additions, and a growing preference for low-maintenance turbine solutions.

Market expansion is further supported by repowering initiatives across Europe, where aging wind farms are being upgraded with more efficient and reliable turbine technologies. As installation costs gradually decline and technological maturity improves, direct drive systems are expected to capture a larger share of both onshore and offshore wind projects across the continent.

Rising Offshore Wind Installations

Offshore wind energy is one of the most significant growth drivers for the Europe direct drive wind turbine market. Europe leads the global offshore wind sector, with large-scale developments in the North Sea, Baltic Sea, and Atlantic regions. Direct drive turbines are particularly well suited for offshore environments due to their simplified mechanical design and reduced risk of gearbox failure, which is critical in remote and harsh marine conditions.

As governments and utilities pursue ambitious offshore capacity targets to meet climate neutrality goals, demand for reliable, high-capacity turbine technologies continues to rise. Direct drive systems help lower total cost of ownership over the turbine lifecycle by minimizing downtime and maintenance interventions, making them an increasingly preferred choice for offshore developers.

Supportive Government Policies and Renewable Energy Targets

Strong policy support across Europe plays a crucial role in driving the direct drive wind turbine market. The European Union’s long-term climate strategies place renewable energy at the core of future energy systems. Programs focused on emissions reduction, clean energy deployment, and grid modernization encourage investment in efficient and innovative wind technologies.

National governments complement EU-level initiatives through subsidies, feed-in tariffs, auction mechanisms, and streamlined permitting processes. These measures reduce financial risk for developers and accelerate the adoption of advanced turbine designs. The alignment of policy, financing, and infrastructure development continues to create a favorable environment for the expansion of direct drive wind technology across Europe.

Technological Advancements in Generator Design

Technological innovation is a key enabler of growth in the Europe direct drive wind turbine market. Advances in generator technologies, particularly permanent magnet synchronous generators and electrically excited synchronous generators, have significantly improved turbine efficiency and reliability. Improvements in materials, cooling systems, and digital monitoring have enhanced energy conversion rates while reducing nacelle weight and operational losses.

The integration of digital control systems and predictive maintenance tools allows operators to monitor turbine performance in real time, optimize energy output, and reduce unplanned outages. As research and development investments continue, direct drive turbines are becoming more cost-competitive and attractive for a broader range of wind projects.

High Initial Capital Investment as a Market Challenge

Despite their long-term benefits, direct drive wind turbines require higher initial capital investment compared to traditional geared systems. The use of specialized components, advanced generators, and sophisticated manufacturing processes contributes to elevated upfront costs. For smaller developers or projects with limited financing, these costs can act as a barrier to adoption, particularly in onshore applications with tighter budgets.

Although lifecycle savings from reduced maintenance and improved reliability often offset the initial expense, financing constraints may still influence technology selection. Addressing this challenge will require continued cost reductions, supportive financing mechanisms, and broader awareness of long-term economic benefits.

Dependence on Rare Earth Materials

Another notable challenge in the Europe direct drive wind turbine market is dependence on rare earth materials. Many permanent magnet direct drive turbines rely on elements such as neodymium and dysprosium, which have limited global supply and are subject to price volatility and geopolitical risks. Europe currently relies heavily on imports for these materials, raising concerns about supply chain resilience.

In response, manufacturers and research institutions are exploring alternatives, including electrically excited synchronous generators that do not require rare earth magnets. While progress is being made, large-scale adoption of alternative technologies remains gradual, and material dependency continues to influence market dynamics.

Electrically Excited Synchronous Generator Segment

Electrically excited synchronous generators are gaining attention as a viable alternative to permanent magnet systems in Europe. These generators eliminate the need for rare earth materials while maintaining high efficiency and scalability. Their design aligns well with Europe’s focus on resource sustainability and supply chain security.

EESG-based direct drive turbines are increasingly considered for large onshore and offshore projects where long-term material availability and geopolitical risk mitigation are priorities. As performance improvements continue, this segment is expected to play a more prominent role in future turbine deployments.

Capacity-Based Market Dynamics

Direct drive wind turbines are deployed across a wide range of capacity segments. Less than 1 MW turbines are commonly used in community energy projects, rural electrification, and hybrid renewable systems. Their quiet operation, low maintenance requirements, and efficiency in low-wind conditions make them suitable for decentralized applications.

Mid-range turbines between 1 MW and 3 MW dominate many onshore installations, offering a balance between cost and performance. Turbines above 3 MW are primarily used in offshore wind farms, where high capacity and reliability are critical for maximizing energy output and economic returns.

Onshore Direct Drive Wind Turbine Market

Onshore wind remains a vital component of Europe’s renewable energy mix. Direct drive turbines are increasingly adopted for repowering projects, where older geared turbines are replaced with modern, high-efficiency systems. The improved reliability and reduced maintenance requirements of direct drive designs are particularly beneficial for wind farms located in remote or difficult-to-access areas.

As land availability becomes more constrained and performance expectations rise, developers are favoring turbines that deliver higher capacity factors and lower operational risk, supporting steady growth in the onshore direct drive segment.

Offshore Direct Drive Wind Turbine Market

The offshore segment represents the fastest-growing application area for direct drive wind turbines in Europe. Offshore projects demand robust and low-maintenance solutions capable of withstanding extreme environmental conditions. Direct drive turbines meet these requirements by reducing mechanical complexity and improving long-term reliability.

Large-scale offshore developments in the North Sea and surrounding waters continue to drive demand for high-capacity direct drive systems. With strong government backing and long-term power purchase agreements, offshore wind remains a cornerstone of Europe’s renewable energy strategy.

France Direct Drive Wind Turbine Market

France is strengthening its position in the European wind energy landscape through increased offshore development and industrial investment. The country’s emphasis on domestic manufacturing and innovation aligns well with the adoption of direct drive turbine technology. Both offshore installations and onshore repowering initiatives are contributing to market growth, making France an important emerging market for advanced wind systems.

Germany Direct Drive Wind Turbine Market

Germany remains Europe’s largest and most technologically advanced wind energy market. The country активно adopts direct drive turbines for both repowering aging infrastructure and developing new offshore capacity. Strong engineering expertise, a mature supply chain, and sustained investment in research and development position Germany as a leader in high-efficiency turbine innovation.

United Kingdom Direct Drive Wind Turbine Market

The United Kingdom’s ambitious offshore wind targets are a major driver of direct drive turbine adoption. Offshore conditions, combined with long-term cost efficiency goals, make low-maintenance turbine designs highly attractive. Government incentives, private investment, and local manufacturing initiatives continue to support rapid deployment of direct drive systems in UK waters.

Russia Direct Drive Wind Turbine Market

Russia’s direct drive wind turbine market is still at an early stage but shows gradual progress as renewable energy gains policy attention. Direct drive systems offer advantages in remote and cold regions where maintenance access is limited. While geopolitical factors and supply chain constraints present challenges, pilot projects and localized manufacturing efforts indicate growing interest in robust wind technologies.

Market Segmentation Overview

The Europe direct drive wind turbine market is segmented by technology, capacity, deployment location, and country. Technology segments include electrically excited synchronous generators and permanent magnet synchronous generators. Capacity segmentation covers less than 1 MW, 1 MW to 3 MW, and greater than 3 MW turbines. Deployment locations are divided into onshore and offshore applications.

Geographically, the market spans major European countries including France, Germany, Italy, Spain, the United Kingdom, and emerging markets across Eastern and Southern Europe.

Competitive Landscape and Key Players

The competitive landscape of the Europe direct drive wind turbine market is characterized by strong technological innovation and strategic partnerships. Leading players include Siemens Gamesa Renewable Energy SA, ENERCON GMBH, ABB Ltd, VENSYS Energy AG, and Leitner AG.

Companies are evaluated based on company overview, leadership, recent developments, SWOT analysis, and revenue performance. As Europe continues to prioritize clean energy, competition is expected to intensify, driving further innovation and solidifying the long-term growth outlook for the direct drive wind turbine market.