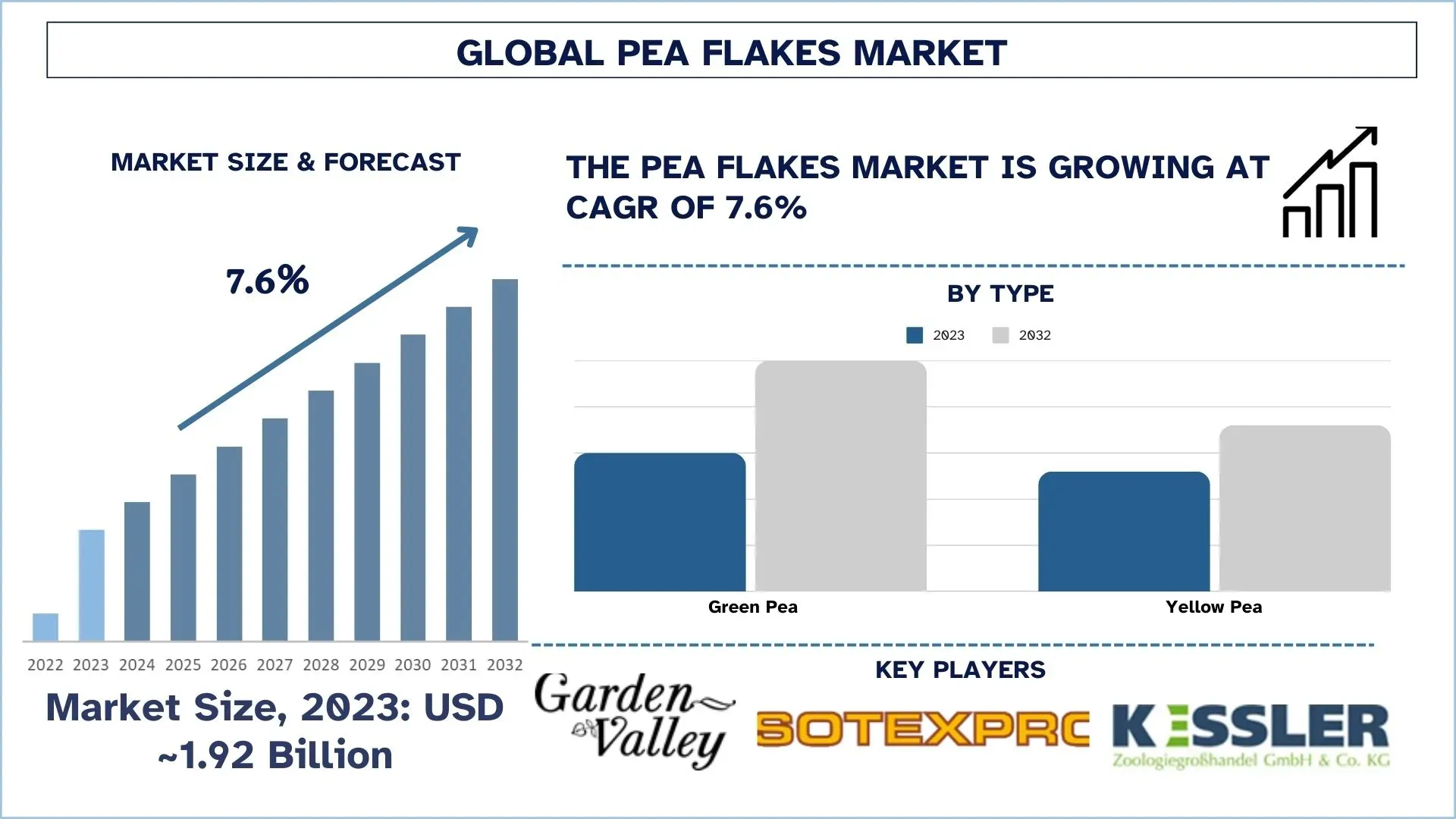

According to a new report by UnivDatos, the Pea Flakes Market is expected to reach USD Billion in 2032 by growing at a CAGR of 7.6% during the forecast period (2024-2032).

Key Highlights of the Report:

Diurnal Protein Supply: According to the National Sample Survey (NSS) 2020, the average daily protein supply from plant-based foods is around 47 grams per person per day in India. The consumption of plant-based protein fluctuates from country to country.

Health Benefits: A higher proportion of plant-based protein is directly proportional to the lower risk of diseases and cardiovascular mortality. The supplementary 3% plant-based energy may reduce a 5 % lower risk of death from all causes.

Efficiency: On average, livestock animals require up to 10 pounds of plant-based protein to produce 1 pound of animal protein.

Environmental impact: Replacing conventional meat with plant-based protein sources can perpetually mitigate greenhouse gas emissions by 30% to 90%.

Investment and innovations: Many emerging countries of South Asia such as China and Singapore have emerged as the capital hotspots for innovations and investments for entrepreneurs in the plant-based protein sector.

The shift towards pet food and wellness has drastically increased the expenditures on pets and related foods, and services. Increasing health consciousness among individuals, rising awareness about the nutritional content of food, shift towards vegetarian food, and expansion in the food processing industry also boost this market. Also, increasing R&D, investment, product advancements, and collaborations in this industry drive the Pea Flakes market. The ongoing research and developments in the pea flakes processing technology through enhancements of new features have tremendously grown the market. For instance, in December 2021, Finnish food technology company Gold & Green Foods launched protein granules and protein flakes made from oat bran, pea, and fava bean protein. The plant-based ingredients have a neutral flavor profile and texture that can be manipulated to adapt to various applications, according to the company. They are a good source of protein and contain fiber, potassium, and iron. For instance, In June 2024 Lovingly Made Flour Mills, TMRW Foods, and Dutton Farms announced to combine their expertise to add value to Canadian pea and fava crops.

Access sample report (including graphs, charts, and figures) - https://univdatos.com/reports/pea-flakes-market?popup=report-enquiry

Here are five examples of government regulations, laws, and legal frameworks that influence the pea flakes market:

Health Considerations

· Pea flakes are nutritious food made from yellow and green peas, which are made by husking and flaying their layers, later by flattening and drying them. They are used as a chewable for the animals and as the food processing ingredient for the soups, stews, and snacks. Nowadays they have gained immense popularity among their consumers due to their health consciousness and plant-based sources. The growing demand for natural, eco-friendly, and vegan products enables compliance with government regulations, laws, and food standards.

Some of the government regulations in the United States are:

1. American Medical Association: As per the standards laid under the AMA, it includes the products for rice, whole dry peas, split peas, feed peas, lentils, and beans. The U.S. Standards for whole dry peas, split peas, feed peas, lentils, and beans no longer appear in the Code of Federal Regulations but are now maintained by the USDA-AMS-Federal Grain Inspection Service (AMS-FGIS)

2. Trade and Export Regulations: U.S. exporters must comply with the United States Department of Agriculture (USDA) foreign policies. This manages the export of agricultural products, including pea flakes. Exporters must adhere to the policies of international trade agreements and regulations ensuring the products meet international standards.

3. Food Safety Regulations: As per United States food safety regulations, pea flakes must adhere to the regulations laid by the Federal Food, Drug, and Cosmetic Act (FFDCA) that ensures the safety, sanitation, and labeling of the food product.

4. Environment Regulations: The Environmental Protection Agency (EPA) must control and manage the use of pesticides and other chemicals with harmful impacts on the environment. This incorporates the cultivation of peas used for the pea flakes.

5. Federal Crop Insurance Corporation (FCIC): As per the Federal Crop Insurance Corporation (FCIC), it should provide crop insurance such as insurability criteria, replanting payments, and winter coverage for the dry peas, incorporating pea flakes.

Food certificates with International Standards

ISO 22000 is the leading international standard food certificate that specifies the requirements for food safety management system (FSMS) ensuring the food safety along with the food chain up to the final consumption.

HACCP (Hazard Analysis and Critical Control Points): This is a systematic preventive approach to food safety that addresses physical, chemical, and biological hazards as a means of prevention rather than finished product inspection.

According to the report, the impact of pea flake resources has been identified to be high for the Asia-Pacific area. Some of how this impact has been felt include:

Asia-Pacific is anticipated to grow with a significant CAGR in the forecast period (2024-2032). The increasing health consciousness along with the spiralling proclivity towards plant-based protein sources fuel the pea flakes market in the Asia-Pacific region. Asia-Pacific region has hauled from traditional snacks to organic and more nutritious snacks. Also, after COVID-19, consumers have started paying attention more to their health and immunity. The continuing research & development in the agro-based and food processing industries also contribute to the growth of the Pea Flakes market. For instance, on May 14, 2024, Roquette, a global leader in plant-based ingredients and a leading provider of pharmaceutical and nutraceutical excipients, announced the launch of its new LYCAGEL® Flex hydroxypropyl pea starch premix for nutraceutical and pharmaceutical soft gel capsules. Built on Roquette’s market-first LYCAGEL pea starch technology, the new plasticizer-free excipient gave manufacturers freedom to select the optimal plasticizer combination and customize formulations for a range of production and end-user needs, while setting new standards in quality, stability, and performance for plant-based softgels.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2024−2032.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis By Type, By Application, By Distribution channel, and Region

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Contact Us:

Email - [email protected]

Website - www.univdatos.com